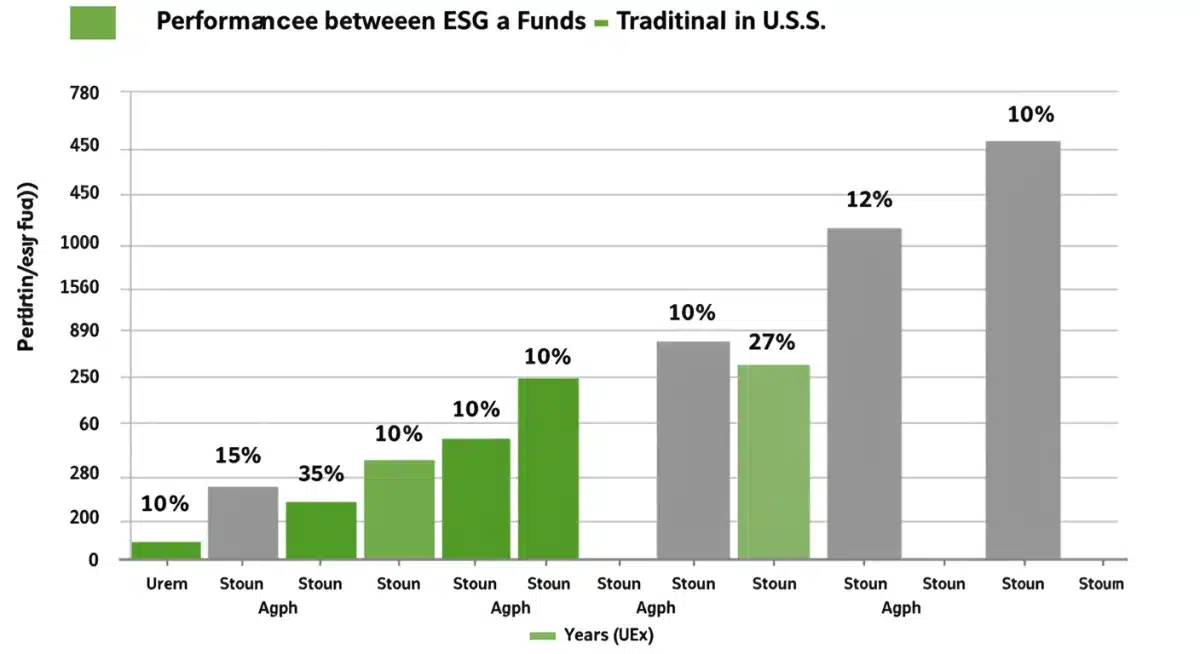

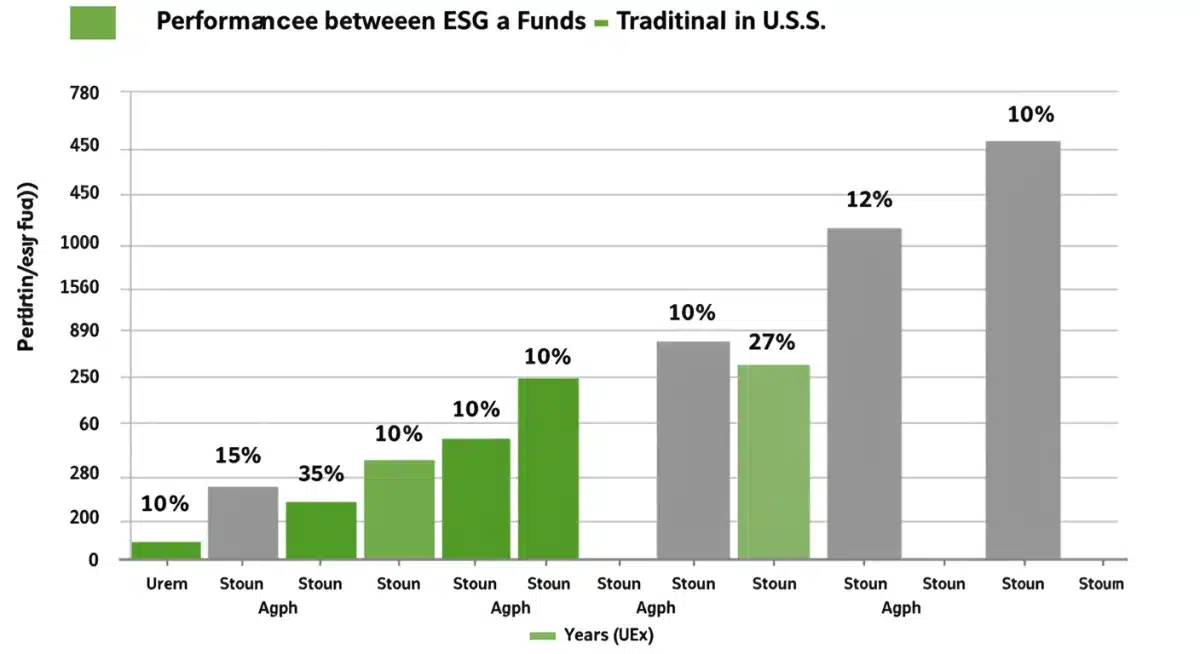

Sustainable Investing: U.S. ESG Funds Outperformed by 10%

Anúncios

U.S. investors embracing sustainable investing strategies, particularly through ESG funds, experienced a significant 10% higher return over a three-year span, highlighting the financial viability of socially responsible portfolios.

Anúncios

For many years, the notion of aligning financial investments with personal values seemed to imply a trade-off: either you pursued profit, or you pursued purpose. However, recent data has begun to dismantle this long-held belief, revealing a compelling narrative where ethical considerations can, in fact, enhance financial performance. This is particularly evident in the realm of sustainable investing returns, where U.S. investors have observed a remarkable trend: a 10% higher return in ESG (Environmental, Social, and Governance) funds over the past three years compared to their traditional counterparts. This compelling statistic isn’t just a fleeting anomaly; it represents a significant shift in how we perceive and approach wealth creation, proving that doing good can also mean doing well.

The evolving landscape of sustainable investing

The concept of sustainable investing has gradually moved from a niche interest to a mainstream financial strategy, driven by a growing awareness of global challenges and a desire for investments to reflect broader societal values. This evolution has been particularly pronounced in the United States, where both individual and institutional investors are increasingly scrutinizing the environmental, social, and governance practices of the companies they invest in.

Anúncios

Initially, sustainable investing, often referred to as socially responsible investing (SRI), primarily focused on negative screening—excluding companies involved in industries like tobacco, weapons, or fossil fuels. While this approach remains relevant, the modern sustainable investing landscape is far more sophisticated, incorporating positive screening, impact investing, and thematic investments that actively seek out companies contributing to a more sustainable future.

Beyond ethical screens: a holistic approach

Today, sustainable investing is not merely about avoiding harm; it’s about actively seeking out companies that demonstrate strong ESG performance across their operations. This holistic approach recognizes that companies with robust ESG policies are often better managed, more resilient to future risks, and ultimately, more sustainable in the long run. Investors are now looking at a wide array of factors, from a company’s carbon footprint and labor practices to its board diversity and executive compensation.

- Environmental factors: Assessing a company’s impact on the natural world, including climate change, resource depletion, waste, and pollution.

- Social factors: Evaluating a company’s relationships with its employees, suppliers, customers, and the communities where it operates.

- Governance factors: Examining a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

The integration of these diverse factors provides a comprehensive view of a company’s long-term viability and ethical standing. This deeper analysis helps investors identify businesses that are not only financially sound but also prepared for the challenges and opportunities of a rapidly changing world. The shift towards this comprehensive evaluation has been a key driver in the performance of sustainable funds.

The growing availability of data and sophisticated analytical tools has also played a crucial role in enabling investors to make informed decisions about ESG factors. What was once considered subjective is now increasingly quantifiable, allowing for more rigorous evaluation and comparison of companies based on their sustainability performance. This transparency has boosted confidence in sustainable investing strategies.

Understanding the 10% higher return in ESG funds

The statistic that U.S. investors saw a 10% higher return in ESG funds over three years is a powerful testament to the financial potential of sustainable investing. This isn’t just a coincidence; it reflects several underlying factors that contribute to the outperformance of companies with strong ESG credentials.

One primary reason for this superior performance is risk mitigation. Companies that effectively manage their environmental, social, and governance risks are often more resilient to market volatility and unforeseen crises. For instance, companies with strong environmental policies are less likely to face regulatory fines or reputational damage from ecological disasters. Similarly, positive labor practices and strong community relations can reduce operational disruptions and enhance brand loyalty.

Operational efficiency and innovation drive growth

Beyond risk mitigation, ESG-focused companies often demonstrate superior operational efficiency and a greater capacity for innovation. Businesses committed to sustainability frequently find ways to reduce waste, optimize resource use, and develop cleaner, more efficient technologies. These efforts can lead to significant cost savings and open up new market opportunities.

- Reduced operational costs: Implementing energy-efficient practices or waste reduction programs can directly lower expenses.

- Enhanced innovation: A focus on sustainability often sparks creativity, leading to new products, services, and business models.

- Stronger brand reputation: Companies seen as socially responsible tend to attract and retain customers, employees, and investors.

Moreover, the increasing demand for sustainable products and services creates a fertile ground for growth for ESG-aligned companies. As consumers and businesses prioritize sustainability, companies that can meet these demands are well-positioned to capture market share and expand their revenues. This trend is likely to continue as global awareness of sustainability issues deepens.

The outperformance also suggests a growing market recognition of the intrinsic value of good corporate citizenship. Investors are increasingly willing to pay a premium for companies that are not only profitable but also responsible. This shift in investor sentiment provides a tailwind for ESG funds, driving up valuations and contributing to higher returns.

Key drivers behind ESG outperformance

Delving deeper into the reasons for the superior performance of ESG funds reveals a confluence of factors, each contributing to the positive financial outcomes observed by U.S. investors. It’s not a single silver bullet but rather a combination of strategic advantages that collectively propel these funds forward.

One significant driver is the increasing regulatory pressure and policy support for sustainable practices. Governments worldwide, including in the U.S., are implementing policies aimed at combating climate change, promoting social equity, and enhancing corporate governance. Companies that are already aligned with these evolving regulations are better prepared for future changes, avoiding costly transitions or penalties, and often benefiting from incentives.

Another crucial element is the shifting demographics of investors. Younger generations, particularly millennials and Gen Z, are more inclined to invest in companies that reflect their values. This demographic shift is channeling significant capital into ESG funds, creating a robust demand that can support higher valuations and consistent growth for sustainable companies.

Long-term value creation and resilience

Companies with strong ESG profiles are often characterized by their focus on long-term value creation rather than short-term gains. This strategic outlook leads to more sustainable business models, stronger stakeholder relationships, and greater resilience during economic downturns. Their ability to adapt and innovate in the face of environmental and social challenges makes them more robust investments.

- Stakeholder engagement: Strong relationships with employees, customers, and communities foster loyalty and reduce risks.

- Adaptability to change: Proactive management of ESG issues prepares companies for future market shifts and disruptions.

- Access to lower cost of capital: Lenders and investors are increasingly favoring sustainable businesses, potentially offering better financing terms.

Furthermore, the improved data availability and standardization in ESG reporting have made it easier for investors to identify truly sustainable companies and funds. This transparency helps to distinguish genuine ESG leaders from those merely engaging in ‘greenwashing,’ providing investors with greater confidence in their choices. The increasing sophistication of ESG metrics allows for more informed and strategic investment decisions, contributing to the observed outperformance.

The collective impact of these drivers creates a powerful virtuous cycle: as more investors flock to ESG funds, companies are incentivized to improve their ESG practices, which, in turn, further enhances their financial performance and attractiveness to investors. This dynamic helps explain the consistent and significant returns seen in sustainable investing.

Navigating the ESG investment landscape in the U.S.

For U.S. investors looking to capitalize on the benefits of sustainable investing, understanding the diverse and evolving landscape is crucial. The market offers a wide array of options, from broad-based ESG funds to highly specialized impact investments, each catering to different risk appetites and sustainability goals.

One of the first steps is to define personal sustainability objectives. Are you primarily concerned with environmental issues, social justice, or corporate governance? Or a combination of all three? Clarifying these priorities will help narrow down the vast selection of available funds and strategies. Many financial advisors now specialize in sustainable investing and can provide tailored guidance.

Choosing the right ESG vehicles

The primary avenues for U.S. investors to engage in sustainable investing include mutual funds, exchange-traded funds (ETFs), and directly investing in companies with strong ESG profiles. Each option has its own advantages and considerations regarding diversification, liquidity, and expense ratios.

- ESG mutual funds: Managed by professionals, these funds offer diversification across a basket of sustainable companies, but typically come with higher fees.

- ESG ETFs: Often passively managed, tracking an ESG index, these provide broad market exposure to sustainable companies with generally lower expense ratios.

- Individual stocks: For those who prefer direct ownership, researching and investing in specific companies known for their strong ESG performance is an option, though it requires more due diligence and carries higher individual stock risk.

It’s also important to look beyond a fund’s marketing and delve into its actual holdings and methodology. Some funds may simply exclude a few controversial industries, while others actively seek out ESG leaders or engage in shareholder advocacy. Tools and ratings from independent research firms can help investors assess the true ESG commitment of a fund or company.

Furthermore, staying informed about market trends and regulatory developments in the sustainable finance space is vital. The landscape is dynamic, with new opportunities and challenges constantly emerging. Engaging with financial news, research reports, and expert opinions can help investors adapt their strategies to maximize both financial returns and positive impact.

Challenges and considerations for sustainable investors

While the allure of higher returns and positive impact in sustainable investing is strong, U.S. investors should also be aware of the challenges and considerations inherent in this evolving field. Navigating these complexities effectively can help ensure that investment decisions align with both financial goals and ethical principles.

One significant challenge is the issue of ‘greenwashing,’ where companies or funds may overstate their environmental or social credentials to attract investors without genuinely integrating sustainable practices. This can make it difficult for investors to identify truly impactful and ethically robust investment opportunities. Diligent research and reliance on reputable third-party ratings are essential to mitigate this risk.

Data consistency and reporting standards

Another consideration is the variability in ESG data and reporting standards. While progress has been made, there isn’t a universal framework for ESG disclosure, leading to inconsistencies in how companies report their sustainability performance. This can complicate direct comparisons between companies and make it harder to assess their true ESG risks and opportunities.

- Lack of standardized metrics: Different ESG rating agencies use varying methodologies and criteria, leading to diverse scores for the same company.

- Self-reported data: Much of the ESG data is self-reported by companies, which can sometimes lack independent verification.

- Evolving regulations: The regulatory landscape for ESG reporting is still developing, which can create uncertainty for investors.

Moreover, some critics argue that integrating ESG factors can sometimes limit the investment universe, potentially leading to less diversified portfolios. While the data on outperformance suggests this isn’t always the case, investors should still ensure their sustainable portfolios remain adequately diversified to manage risk effectively.

Finally, the long-term nature of many sustainability challenges means that the full impact and financial benefits of ESG investments may not always be immediately apparent. Sustainable investing often requires a patient, long-term perspective, aligning with a strategy of compounding returns and gradual positive change. Investors should be prepared for this extended horizon when committing to ESG funds.

The future outlook for sustainable investing in the U.S.

The trajectory for sustainable investing in the U.S. appears to be one of continued growth and increasing sophistication. The trends observed over the past three years, particularly the 10% higher return in ESG funds, suggest that this is not a temporary phenomenon but a fundamental shift in investment strategy that is likely to endure and expand.

Several factors point towards this optimistic outlook. The increasing urgency of climate change and social inequality will continue to drive demand for investments that address these critical issues. As younger generations accumulate wealth, their inherent preference for sustainable and ethical consumption and investment will further accelerate the adoption of ESG strategies.

Technological advancements and data solutions

Technological advancements will also play a pivotal role in shaping the future of sustainable investing. Improved data analytics, artificial intelligence, and blockchain technology can enhance the accuracy, transparency, and accessibility of ESG data, making it easier for investors to identify and evaluate truly sustainable opportunities.

- AI-driven ESG analysis: Advanced algorithms can process vast amounts of data to provide more nuanced ESG insights.

- Blockchain for supply chain transparency: This technology can verify the ethical and environmental credentials of products and supply chains.

- Impact measurement tools: Better tools will emerge to quantify the real-world impact of investments, moving beyond financial returns alone.

Furthermore, regulatory bodies are likely to introduce more robust and standardized ESG reporting requirements, which will help to mitigate greenwashing and provide investors with clearer, more comparable information. This regulatory clarity will boost investor confidence and streamline the process of identifying high-quality sustainable investments.

The integration of ESG factors into mainstream financial analysis will also deepen. What was once considered an ‘alternative’ approach is rapidly becoming an integral part of fundamental analysis, with financial institutions increasingly incorporating ESG risks and opportunities into their valuation models. This mainstreaming will solidify sustainable investing as a core component of prudent financial management, ensuring its continued relevance and growth in the U.S. investment landscape.

Integrating ESG into your investment strategy

For U.S. investors, the time is ripe to reconsider traditional investment approaches and strategically integrate ESG principles into their portfolios. The documented outperformance of ESG funds, coupled with the growing global imperative for sustainability, presents a compelling case for a more conscious and forward-thinking investment strategy. This integration can lead to both enhanced financial returns and a positive impact on the world.

A key first step involves a personal assessment of your values and financial objectives. What environmental, social, or governance issues resonate most with you? How do these align with your long-term financial goals? This self-reflection will guide your choices and ensure that your investments truly reflect your personal ethos while working towards your financial aspirations.

Practical steps for integration

Integrating ESG into your strategy doesn’t require a complete overhaul of your existing portfolio overnight. It can be a gradual process, starting with small adjustments and expanding as you gain confidence and understanding. Seeking advice from financial professionals who specialize in sustainable investing can provide invaluable support and tailored recommendations.

- Start with an ESG fund: Consider allocating a portion of your portfolio to a diversified ESG mutual fund or ETF to gain exposure.

- Review existing holdings: Evaluate the ESG performance of companies currently in your portfolio and consider rebalancing if they don’t align with your values.

- Engage with shareholder activism: For those with direct stock holdings, consider supporting shareholder resolutions that promote better ESG practices.

Moreover, continuous education about the nuances of sustainable finance is essential. The field is constantly evolving, with new research, products, and best practices emerging regularly. Staying informed will enable you to make agile adjustments to your strategy and capitalize on new opportunities as they arise.

Ultimately, integrating ESG into your investment strategy is about recognizing that financial success and societal well-being are not mutually exclusive but deeply interconnected. By choosing to invest sustainably, you are not only positioning yourself for potentially higher returns but also contributing to a more resilient, equitable, and environmentally sound future. This powerful combination makes sustainable investing a truly compelling path for the modern U.S. investor.

| Key Aspect | Brief Description |

|---|---|

| Higher Returns | U.S. ESG funds showed a 10% higher return over three years compared to traditional funds. |

| Risk Mitigation | Strong ESG practices lead to greater company resilience and reduced exposure to various risks. |

| Operational Efficiency | ESG-focused companies often achieve cost savings and foster innovation through sustainable practices. |

| Market Demand | Growing investor and consumer demand fuels growth for sustainable products and services. |

Frequently asked questions about sustainable investing

Sustainable investing integrates environmental, social, and governance (ESG) factors into investment decisions to generate competitive financial returns alongside positive societal impact. It moves beyond traditional financial analysis to consider a company’s broader impact and long-term viability, aligning investments with ethical values.

The higher returns are attributed to several factors: enhanced risk mitigation, better operational efficiency, increased innovation, and growing market demand for sustainable companies. Companies with strong ESG practices are often more resilient, adaptable, and attractive to modern investors, leading to superior financial performance.

While ethical considerations are a core component, recent data, such as the 10% higher return in U.S. ESG funds, clearly demonstrates that sustainable investing can be highly profitable. It challenges the old notion of a trade-off, proving that purpose and profit can effectively go hand-in-hand.

U.S. investors can start by defining their personal ESG priorities, then exploring ESG mutual funds, exchange-traded funds (ETFs), or individual stocks with strong sustainability profiles. Consulting with a financial advisor specializing in sustainable investing can also provide tailored guidance and portfolio construction.

Challenges include ‘greenwashing’ (misleading ESG claims), inconsistencies in ESG data and reporting standards, and the potential for a more limited investment universe. Investors should conduct thorough due diligence, rely on reputable ratings, and ensure portfolio diversification to mitigate these risks effectively.

Conclusion

The compelling evidence of U.S. ESG funds delivering a 10% higher return over three years marks a pivotal moment in the investment world. It decisively demonstrates that sustainable investing is not merely an ethical choice but a financially astute strategy that can outperform traditional approaches. This trend underscores the growing recognition that companies committed to strong environmental, social, and governance practices are inherently more resilient, innovative, and better positioned for long-term success. As the financial landscape continues to evolve, integrating sustainable principles into investment strategies will likely become an indispensable component for investors seeking both robust returns and a positive global impact, ultimately reshaping how wealth is created and managed for future generations.