EV Charging Rebates 2025: Claim Up to $2,000 in State Incentives

Anúncios

U.S. residents can significantly reduce the cost of electric vehicle charging installations in early 2025 by leveraging state rebates, potentially saving up to $2,000, making EV adoption more accessible and affordable.

Anúncios

As the electric vehicle (EV) revolution accelerates, many homeowners are looking to install convenient home charging stations. Fortunately, for U.S. residents, early 2025 brings exciting opportunities to access up to $2,000 in state rebates for electric vehicle charging installations. These incentives are designed to make the transition to electric transportation more affordable and encourage wider adoption, ultimately contributing to a cleaner, more sustainable future.

Understanding the Landscape of EV Charging Rebates in 2025

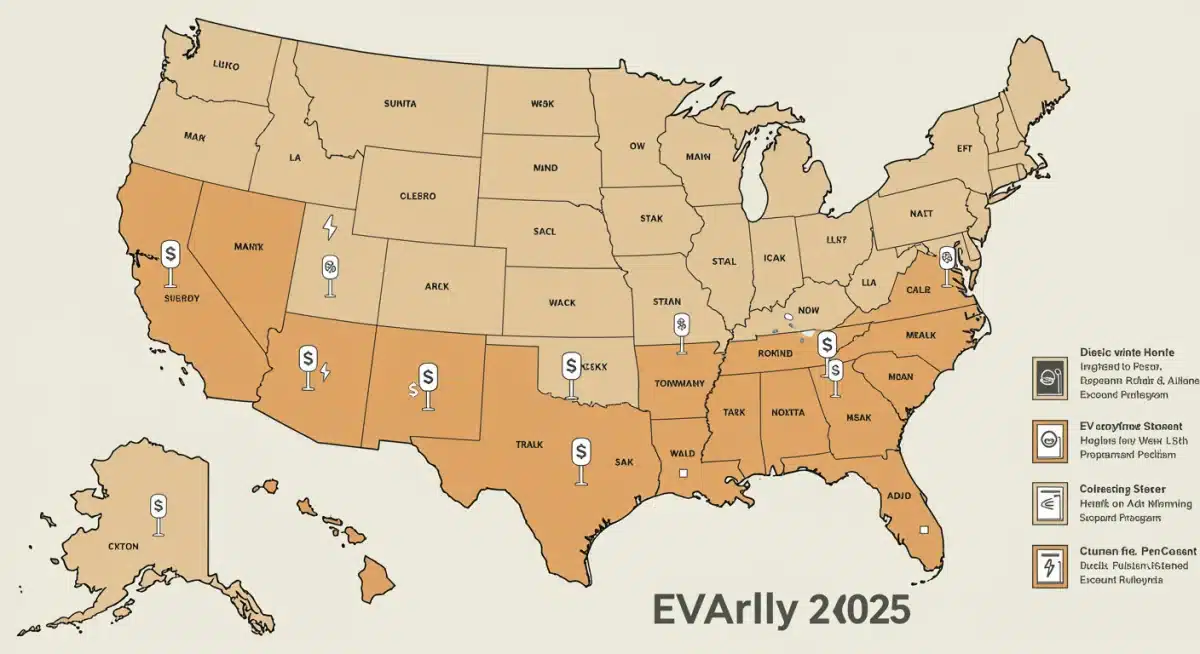

The landscape of electric vehicle charging rebates is dynamic, with various states offering different levels of financial assistance to encourage EV adoption and support the necessary infrastructure. In early 2025, these programs continue to evolve, reflecting state-specific environmental goals, energy policies, and budgetary considerations. Understanding these nuances is crucial for homeowners looking to capitalize on available savings.

Anúncios

These rebates typically target the installation of Level 2 charging stations, which are significantly faster than standard Level 1 outlets and are considered essential for practical home EV charging. The financial incentives can cover a portion of the equipment cost, installation fees, or both, making the initial investment much more manageable. Staying informed about program updates and requirements is key to securing these benefits.

State-Specific Incentives and Eligibility

Each state administers its own rebate programs, leading to variations in eligibility criteria and the amount of financial assistance offered. While some states provide a flat rebate amount, others might offer a percentage of the total project cost, capped at a certain maximum. Homeowners should investigate their specific state’s energy department or public utility commission websites for the most accurate and up-to-date information.

- Residential Property Owners: Most rebates are exclusively for individuals owning residential properties where the EV charger will be installed.

- Qualified Equipment: Only certified Level 2 (240-volt) EV charging stations, meeting specific safety and performance standards, are typically eligible.

- Licensed Installation: Many programs require installation by a licensed electrician to ensure safety and compliance with local codes.

Furthermore, some programs might have income-based eligibility or prioritize installations in certain geographic areas. It is important to review all requirements thoroughly before making a purchase or beginning installation to ensure compliance and maximize your rebate potential. These state-level initiatives are a significant driver in expanding the home charging network across the nation.

Navigating the Application Process for State Rebates

Applying for state rebates for electric vehicle charging installations can seem daunting, but with a clear understanding of the process, it becomes much more manageable. The application procedures vary by state and even by specific program, often involving several steps from initial inquiry to final reimbursement.

Generally, applicants will need to gather documentation related to their EV charging equipment, installation costs, and proof of residency. Starting the application process early is always recommended, as some programs operate on a first-come, first-served basis or have specific deadlines that must be met. Timeliness can be a critical factor in securing your rebate.

Key Steps in the Rebate Application Journey

While specifics differ, a common application journey involves several core stages. Understanding these steps can help homeowners prepare adequately and avoid common pitfalls.

- Research Available Programs: Identify all state, utility, and local programs for which you might be eligible.

- Review Eligibility Criteria: Carefully read all requirements regarding residency, equipment, and installation.

- Gather Documentation: Collect invoices for the charger and installation, proof of purchase, electrician licenses, and any necessary permits.

Many state programs also require pre-approval before installation begins. This step ensures that your planned setup meets all necessary specifications and that funds are available. Neglecting pre-approval could lead to an ineligible installation and the loss of potential rebates. It is always wise to confirm this requirement with your specific program administrator.

Maximizing Your Savings: Combining State, Federal, and Local Incentives

To truly maximize your financial benefits when installing an EV charging station, it is essential to look beyond just state rebates. A multi-layered approach, combining state incentives with federal tax credits and local utility programs, can significantly reduce your out-of-pocket expenses. This strategic stacking of benefits can often lead to savings that far exceed an individual rebate amount.

The federal government, through initiatives like the Alternative Fuel Vehicle Refueling Property Credit, offers tax credits for qualified charging equipment. These credits can often be claimed in addition to state-level rebates, providing a substantial reduction in overall costs. Similarly, many local utility companies offer their own incentives, such as reduced rates for off-peak charging or direct rebates for equipment and installation.

Exploring Federal Tax Credits and Utility Programs

The federal tax credit for alternative fuel vehicle refueling property can cover a percentage of the cost of qualified charging equipment and installation. This credit is typically available to individuals and businesses, with specific limits and requirements that homeowners should verify for the most current tax year.

Local utility companies often play a significant role in promoting EV adoption. Their programs can include:

- Time-of-Use (TOU) Rates: Lower electricity rates for charging during off-peak hours, saving money on daily operation.

- Direct Rebates: Cash back for purchasing or installing specific EV charger models.

- Smart Charging Programs: Incentives for allowing the utility to manage charging times to optimize grid stability.

By diligently researching and applying for all applicable programs—state, federal, and local—homeowners can create a comprehensive savings strategy. This integrated approach ensures that you are taking full advantage of every available financial incentive, making your EV charging installation as economical as possible and accelerating the return on your investment.

Key Updates and Changes for Early 2025

The landscape of EV charging incentives is continually evolving, with new legislation, budget allocations, and program adjustments occurring regularly. For U.S. residents in early 2025, several key updates and potential changes are anticipated that could impact the availability and scope of state rebates for electric vehicle charging installations.

Many states are refining their programs to better align with federal goals, infrastructure needs, and the growing demand for EVs. This means some rebates might see increased funding, while others could introduce new eligibility requirements or focus on underserved communities. Staying informed about these developments is critical for anyone planning an installation.

Anticipated Program Revisions and New Initiatives

As the electric vehicle market matures, state rebate programs are becoming more sophisticated. Early 2025 is expected to bring several revisions aimed at optimizing these incentives.

- Increased Funding: Some states may allocate more funds to existing programs due to higher demand or new legislative pushes for decarbonization.

- Expanded Eligibility: Certain programs might broaden their scope to include a wider range of charging technologies or different types of residential properties.

- Focus on Equity: New initiatives could emerge to specifically address EV charging access in low-income or rural areas, promoting equitable distribution of benefits.

Furthermore, there’s a growing trend towards incorporating smart charging capabilities into rebate requirements. This encourages the adoption of chargers that can communicate with the grid, helping to manage electricity demand more efficiently. Homeowners should look for chargers that are future-proofed with these capabilities to ensure continued eligibility for potential future incentives. Keeping an eye on state energy office announcements and utility updates will provide the most current information regarding these important changes.

Impact on Homeowners: Financial Benefits and Environmental Contribution

The availability of state rebates for electric vehicle charging installations offers significant financial benefits to homeowners, directly reducing the upfront cost of adopting EV technology. Beyond the immediate savings, these incentives also foster a broader environmental contribution, aligning individual actions with larger sustainability goals.

For many households, the initial investment in an EV charger can be a barrier. Rebates effectively lower this hurdle, making the decision to go electric more accessible and appealing. This financial relief facilitates the switch from gasoline-powered vehicles, leading to reduced carbon emissions and improved air quality in local communities. The long-term savings on fuel costs further amplify the financial advantages of owning an EV.

Beyond the Dollars: Environmental and Lifestyle Advantages

While the financial incentives are a major draw, the impact of installing an EV charger extends to significant environmental and lifestyle advantages. These benefits accrue both to the individual homeowner and the broader community.

Environmentally, every EV charger installed signifies a step away from fossil fuels. This contributes to:

- Reduced Greenhouse Gas Emissions: Less reliance on gasoline means fewer pollutants released into the atmosphere.

- Improved Air Quality: Especially in urban areas, increased EV adoption leads to cleaner local air.

- Support for Renewable Energy: Charging EVs, particularly with home solar, further boosts demand for clean energy sources.

From a lifestyle perspective, having a home charging station provides unparalleled convenience. No more detours to gas stations or waiting at public chargers; simply plug in overnight and wake up to a fully charged vehicle. This convenience, combined with the financial relief from rebates, makes the EV ownership experience significantly more appealing and sustainable for homeowners across the U.S.

Future Outlook: Sustained Growth and Evolving Incentives

The trajectory for electric vehicle adoption in the U.S. points towards sustained growth, and with it, the continued evolution of incentives for charging infrastructure. Early 2025 serves as a crucial period for understanding current offerings, but it is equally important to look ahead at how these programs are likely to develop over time. The push for electrification is a long-term commitment, and incentives will adapt accordingly.

As the EV market matures, federal, state, and local governments will likely refine their strategies, potentially shifting focus from broad installation incentives to more targeted programs. This could include support for smart charging technologies, grid integration, or initiatives aimed at ensuring equitable access across all demographics. The goal remains to build a robust and accessible charging network.

Innovations and Policy Directions Anticipated

The future of EV charging incentives is closely tied to technological advancements and policy directions. Several key trends are expected to shape the landscape beyond early 2025.

- Vehicle-to-Grid (V2G) Technology: Incentives may emerge for V2G-compatible chargers, allowing EVs to feed power back into the grid during peak demand.

- Enhanced Grid Integration: Policies will likely encourage chargers with advanced communication capabilities to support grid stability.

- Community Charging Solutions: Greater emphasis might be placed on multi-unit dwelling (MUD) charging and public access points.

Furthermore, there’s a strong likelihood that rebate programs will become increasingly sophisticated, perhaps tying incentives to specific charger features, energy efficiency standards, or even local renewable energy integration. Homeowners who invest in adaptable and technologically advanced charging solutions now may find themselves better positioned to benefit from future incentives. Staying engaged with clean energy news and policy updates will be key to navigating this evolving landscape and maximizing long-term benefits from your EV charging setup.

| Key Point | Brief Description |

|---|---|

| State Rebate Potential | U.S. residents can access up to $2,000 in state rebates for EV charging installations in early 2025. |

| Eligibility Varies | Programs differ by state, requiring specific residential ownership, qualified equipment, and licensed installation. |

| Maximize Savings | Combine state rebates with federal tax credits and local utility incentives for optimal financial benefit. |

| Future Trends | Expect evolving programs, increased funding, and focus on smart charging and equitable access. |

Frequently Asked Questions About EV Charging Rebates

Most state rebates primarily cover Level 2 (240-volt) residential electric vehicle charging stations. These chargers provide significantly faster charging speeds than standard Level 1 outlets. Eligibility often requires the equipment to be new, certified, and installed by a licensed electrician, ensuring safety and compliance with local electrical codes.

Yes, in most cases, homeowners can combine state rebates with federal tax credits, such as the Alternative Fuel Vehicle Refueling Property Credit. This stacking of incentives can significantly increase your total savings. Always verify the specific rules for each program, as some may have clauses regarding combining benefits, though this is uncommon for federal and state programs.

The best way to find specific rebate programs is to visit your state’s energy department website or public utility commission. Local utility companies often also offer their own incentives. Search for terms like “EV charger rebates [Your State]” to find the most relevant and up-to-date information, including eligibility and application details.

Some state and local rebate programs may include income-based eligibility requirements, often designed to ensure equitable access to EV technology. However, many programs are available to all residential property owners regardless of income. It is crucial to check the specific program guidelines for any income limitations or prioritization for low-to-moderate income households.

Commonly required documentation includes proof of purchase for the EV charger, an invoice from a licensed electrician for the installation, proof of residency, and sometimes a copy of your electric bill or EV registration. Some programs may also require a pre-approval form before installation begins. Always keep detailed records of all transactions.

Conclusion

The opportunity to access up to $2,000 in state rebates for electric vehicle charging installations in early 2025 represents a substantial incentive for U.S. residents considering or planning to install a home EV charger. By understanding the varying state programs, navigating the application process diligently, and strategically combining federal and local benefits, homeowners can significantly reduce their investment. These rebates not only make EV adoption more financially attractive but also underscore a collective commitment to a greener, more sustainable future, empowering individuals to play a direct role in the ongoing energy transition.