Optimizing HSAs in 2026: Tax Benefits for US Taxpayers

Anúncios

Optimizing Health Savings Accounts (HSAs) in 2026 provides US taxpayers with unparalleled financial benefits, offering a tax-advantaged strategy for both current and future healthcare expenses.

Anúncios

Are you looking for a powerful way to manage healthcare costs while simultaneously boosting your financial future? Optimizing Health Savings Accounts (HSAs) in 2026: Financial Benefits for US Taxpayers presents a unique opportunity, offering a triple tax advantage that savvy individuals should not overlook.

Anúncios

Understanding the HSA Landscape in 2026

Health Savings Accounts (HSAs) continue to be one of the most powerful financial tools available to eligible US taxpayers. In 2026, the fundamental structure and benefits remain largely consistent, but staying informed about contribution limits and eligible expenses is crucial for maximizing their potential. HSAs are designed to help individuals with high-deductible health plans (HDHPs) save for qualified medical expenses on a tax-advantaged basis.

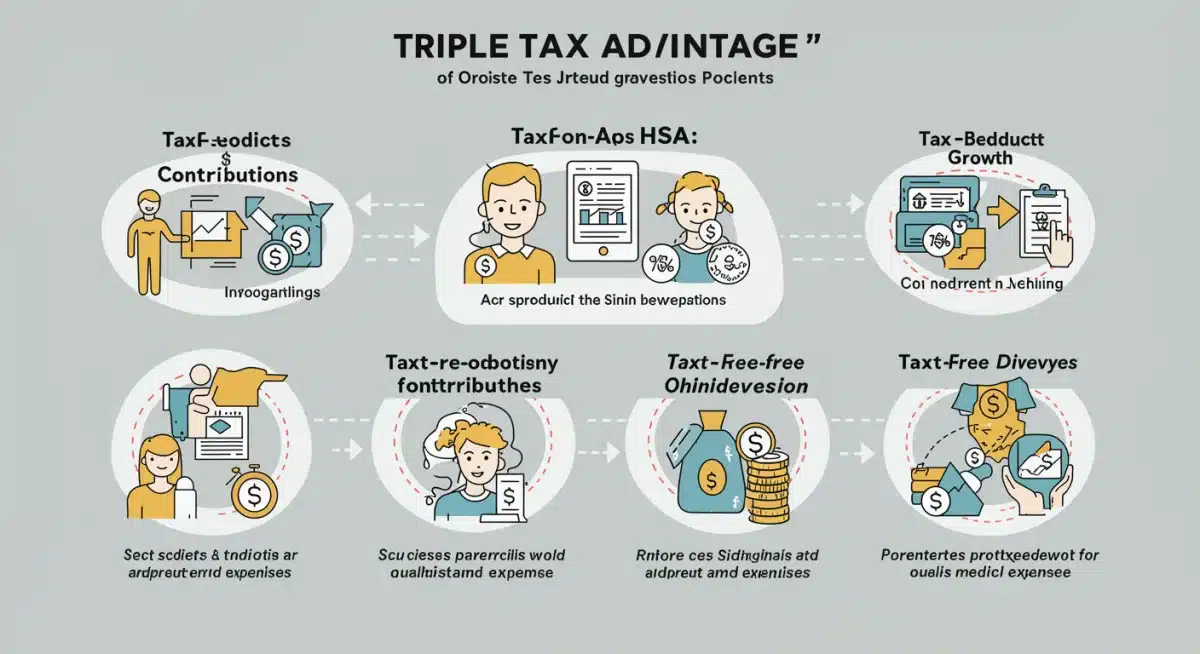

The core appeal of an HSA lies in its unique ‘triple tax advantage.’ Contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This combination makes HSAs an exceptional vehicle not just for healthcare spending, but also for long-term savings and even retirement planning. Understanding how these elements work together is the first step toward effective optimization.

Eligibility Requirements for HSAs

- High-Deductible Health Plan (HDHP): You must be covered by a qualified HDHP. For 2026, the IRS will release specific deductible and out-of-pocket maximum limits that define an HDHP.

- No Other Health Coverage: Generally, you cannot be covered by any other health plan that is not an HDHP (with some exceptions, like specific dental or vision plans).

- Not Enrolled in Medicare: Individuals cannot be enrolled in Medicare.

- Not Claimed as a Dependent: You cannot be claimed as a dependent on someone else’s tax return.

Familiarizing yourself with these eligibility criteria is paramount. If you meet these conditions, an HSA can be a game-changer for your financial health. Even small changes in your health coverage or tax status can impact your eligibility, so it’s wise to review these annually.

In summary, the HSA landscape in 2026 continues to offer significant opportunities for those who qualify. By understanding the basics of eligibility and the triple tax advantage, taxpayers can begin to strategize how to best utilize these powerful accounts for their present and future healthcare needs.

Maximizing Contributions and Tax Deductions

One of the most direct ways to optimize an HSA is by maximizing your annual contributions. The IRS sets specific limits each year, and for 2026, these limits are expected to see a slight increase due to inflation adjustments. Contributing the maximum amount allows you to fully leverage the tax-deductible nature of these contributions, reducing your taxable income.

For individuals aged 55 and over, there’s an additional catch-up contribution permitted, allowing them to save even more. This provision is particularly beneficial for those nearing retirement who may anticipate higher healthcare costs in their later years. Understanding and utilizing these limits is fundamental to a robust HSA strategy.

Understanding Contribution Limits and Catch-Up Contributions

Each year, the Internal Revenue Service (IRS) announces the maximum allowable contributions for HSAs. These limits typically differentiate between self-only coverage and family coverage. It’s essential to stay updated on these figures, as over-contributing can lead to penalties.

- Self-Only Coverage: Expected to be around $4,150 for 2026 (confirm with official IRS announcements).

- Family Coverage: Expected to be around $8,300 for 2026 (confirm with official IRS announcements).

- Catch-Up Contributions: An additional $1,000 annually for individuals aged 55 and older.

These limits are per individual or family, not per HSA. If you have multiple HSAs, the total contributions across all accounts must not exceed the annual limit. Employers often contribute to employee HSAs, and these employer contributions count towards the annual maximum. Always verify your total contributions from all sources.

By consistently contributing the maximum allowed, you not only reduce your current tax burden but also build a substantial fund for future medical expenses. This proactive approach to saving can significantly alleviate financial stress associated with healthcare costs, making it a cornerstone of effective financial planning.

Leveraging Tax-Free Growth and Withdrawals

Beyond the immediate tax deduction on contributions, the true power of an HSA unfolds through its tax-free growth and tax-free withdrawals for qualified medical expenses. This dual advantage positions HSAs as a formidable investment vehicle, often compared to a Roth IRA for healthcare expenses, but with an upfront tax deduction.

Funds within an HSA can be invested in a variety of options, similar to a 401(k) or IRA, including mutual funds, stocks, and bonds. The earnings from these investments grow tax-free, meaning you don’t pay taxes on dividends, interest, or capital gains as long as the funds remain in the account. This compounding growth can lead to a significant accumulation of wealth over time.

Strategic Investment within Your HSA

Choosing the right investment strategy for your HSA is critical. Many HSA providers offer a range of investment options, from conservative money market accounts to more aggressive stock portfolios. Your investment choices should align with your risk tolerance and your anticipated timeline for needing the funds.

- Long-Term Growth: For those who can afford to pay for current medical expenses out-of-pocket, investing HSA funds for long-term growth is an excellent strategy. This allows your money to compound over decades, potentially leading to a substantial nest egg for retirement healthcare costs.

- Diversification: Diversify your HSA investments just as you would with any other retirement account. Avoid putting all your eggs in one basket; spread your investments across different asset classes to mitigate risk.

- Fees: Be mindful of any administrative fees or investment fees charged by your HSA provider, as these can eat into your returns. Research different providers to find one with low fees and a wide array of investment choices.

When it comes time to withdraw funds, ensure they are used for qualified medical expenses. These include deductibles, co-pays, prescriptions, dental care, vision care, and even long-term care insurance premiums. Keeping meticulous records of all medical expenses is vital, as this documentation will support your tax-free withdrawals. This strategic approach ensures you fully benefit from the tax advantages offered.

HSAs as a Retirement Savings Vehicle

While primarily designed for healthcare expenses, HSAs can effectively double as a powerful retirement savings vehicle. Unlike a traditional 401(k) or IRA, an HSA’s funds can be withdrawn tax-free for qualified medical expenses at any age. However, after age 65, the rules become even more flexible, making it a truly unique financial tool.

Once you reach age 65, you can withdraw HSA funds for any purpose, not just medical expenses, without incurring a 20% penalty. While these non-medical withdrawals will be subject to ordinary income tax, similar to a traditional IRA, the tax-free growth and tax-deductible contributions still make it a highly attractive option. This flexibility offers a valuable safety net for retirement, covering both healthcare and other unforeseen expenses.

Integrating HSAs into Your Retirement Plan

Incorporating your HSA into a broader retirement strategy requires foresight and consistent effort. The goal is to accumulate as much as possible in your HSA while you are younger, allowing it to grow substantially over time. This involves making maximum contributions whenever possible and investing wisely.

- Pay Out-of-Pocket: If your financial situation allows, pay for current medical expenses out-of-pocket rather than drawing from your HSA. This strategy leaves your HSA funds invested and growing tax-free for a longer period.

- Keep Records: Meticulously save all receipts for qualified medical expenses, even if you pay for them with other funds. You can reimburse yourself for these expenses from your HSA at any point in the future, even years later, as long as the expense was incurred after your HSA was established.

- Consider Future Healthcare Costs: Healthcare costs in retirement can be substantial. An HSA can help cover Medicare premiums, deductibles, co-pays, and other out-of-pocket expenses, providing significant peace of mind.

Viewing your HSA as a long-term investment, rather than just a checking account for immediate medical needs, can dramatically enhance its value. Its dual function as a healthcare savings account and a flexible retirement fund makes it an indispensable component of a well-rounded financial plan for US taxpayers.

Avoiding Common HSA Pitfalls and Misconceptions

While HSAs offer significant benefits, there are common pitfalls and misconceptions that can hinder their effectiveness if not properly addressed. Understanding these potential issues is just as important as knowing the advantages. One frequent mistake is treating an HSA like a regular checking account, drawing from it for every medical expense rather than allowing the funds to grow.

Another common misunderstanding revolves around eligibility. Changes in health coverage, such as enrolling in Medicare or another non-HDHP, can impact your ability to contribute to an HSA. Failing to track these changes can lead to inadvertent over-contributions, which are subject to penalties from the IRS.

Key Pitfalls to Avoid for Optimal HSA Use

- Over-Contributing: Always be aware of the annual contribution limits. If you accidentally contribute more than allowed, you could face a 6% excise tax on the excess amount each year it remains in the account.

- Using Funds for Non-Qualified Expenses Before Age 65: Withdrawals for non-medical expenses before age 65 are subject to ordinary income tax plus a 20% penalty. This can significantly erode your savings.

- Poor Investment Choices: Leaving HSA funds in a low-interest cash account, especially for long-term savings, means missing out on the tax-free growth potential. Conversely, taking on excessive risk unsuitable for your timeline can also be detrimental.

- Losing Records of Qualified Expenses: Without proper documentation, you may struggle to prove that withdrawals were for qualified medical expenses, potentially leading to taxes and penalties.

It’s also a misconception that HSAs are only for the wealthy. While those with higher incomes may contribute more, the tax advantages benefit individuals across various income brackets. The key is to leverage the account’s features strategically, regardless of your income level. By being vigilant about these common errors, taxpayers can ensure their HSA remains a highly effective financial tool.

Future Outlook and Strategic Planning for 2026 and Beyond

The landscape of healthcare and personal finance is constantly evolving, and HSAs are not immune to these changes. Looking ahead to 2026 and beyond, strategic planning becomes even more critical for maximizing the long-term benefits of these accounts. Anticipating potential changes in legislation, inflation adjustments, and personal circumstances will allow for proactive adaptation.

The continued growth of HDHPs suggests that HSAs will remain a relevant and valuable tool for managing healthcare costs. As medical expenses continue to rise, the ability to save and invest tax-free for these costs becomes increasingly important. Therefore, integrating HSA planning into your overall financial strategy for the coming years is a wise move.

Key Considerations for Long-Term HSA Strategy

A forward-looking approach to your HSA involves more than just annual contributions; it requires a holistic view of your financial life and future needs. This includes thinking about potential changes in your health, employment, and family situation.

- Stay Informed: Regularly check official IRS announcements for updated contribution limits, HDHP definitions, and any legislative changes that might affect HSAs. Financial news outlets and reputable financial advisors are good sources of information.

- Review Your HDHP Annually: Ensure your health insurance plan continues to qualify as an HDHP. Employer plans can change, and it’s your responsibility to confirm eligibility for HSA contributions.

- Consider Your Health Trajectory: As you age, your healthcare needs may increase. Planning how your HSA will cover these escalating costs, especially in retirement, is essential. This might involve adjusting your investment strategy to be more conservative as you approach the age you anticipate needing the funds.

- Estate Planning: Understand how your HSA will be handled upon your death. Spouses can inherit HSAs tax-free, maintaining their tax-advantaged status, while non-spouse beneficiaries may face different tax implications.

By consistently reviewing and adjusting your HSA strategy, you can ensure that it remains an optimized and effective component of your financial portfolio. The long-term benefits of tax-free growth and withdrawals for healthcare expenses, coupled with its potential as a flexible retirement account, make HSAs an indispensable tool for US taxpayers in 2026 and for many years to come.

| Key Aspect | Brief Description |

|---|---|

| Triple Tax Advantage | Contributions are tax-deductible, growth is tax-free, and qualified withdrawals are tax-free. |

| Contribution Limits 2026 | Maximize annual contributions (self-only, family, and catch-up for those 55+) to reduce taxable income. |

| Investment Growth | Invest HSA funds for tax-free growth, using them as a long-term retirement savings vehicle for healthcare. |

| Retirement Flexibility | After age 65, funds can be withdrawn for any purpose without penalty (though non-medical withdrawals are taxed). |

Frequently Asked Questions About HSAs

To be eligible for an HSA in 2026, you must be covered by a high-deductible health plan (HDHP), have no other disqualifying health coverage, not be enrolled in Medicare, and not be claimed as a dependent on someone else’s tax return. Eligibility is crucial for contributions.

HSAs offer a ‘triple tax advantage’: contributions are tax-deductible, funds grow tax-free, and withdrawals for qualified medical expenses are tax-free. This makes them a highly efficient tool for saving and investing for healthcare costs.

Before age 65, withdrawals for non-medical expenses are subject to ordinary income tax and a 20% penalty. After age 65, you can withdraw funds for any purpose without penalty, though non-medical withdrawals will be subject to ordinary income tax.

To maximize investment potential, contribute the maximum allowed annually, and invest your HSA funds in growth-oriented options if you can afford to pay for current medical expenses out-of-pocket. This allows for long-term tax-free compounding of your savings.

Your HSA funds are yours to keep, regardless of changes in employment or health plans. You can continue to use them for qualified medical expenses. If you enroll in Medicare, you can no longer contribute, but you can still use existing funds.

Conclusion

Optimizing Health Savings Accounts (HSAs) in 2026: Financial Benefits for US Taxpayers represents a crucial strategy for both immediate healthcare management and long-term financial security. By diligently maximizing contributions, strategically investing funds, and understanding the nuances of eligibility and withdrawals, individuals can unlock the full potential of these powerful accounts. HSAs are not merely savings vehicles; they are dynamic tools that offer a unique blend of tax advantages, investment growth, and retirement flexibility, making them indispensable components of a comprehensive financial plan for the modern taxpayer.